| |

|---|---|

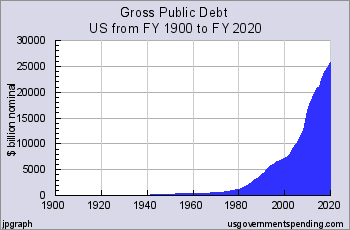

The Budget Deficit and Our National Debt

We've got a deficit and debt problem.

How can we explain it? Let's start with something almost everybody knows about - a home mortgage, and I'll keep it very simple.

-

What is a mortgage? A mortgage is a large, long-term, loan that you get from a lender in order to buy a house you can not afford to pay cash for.

-

How does a mortgage work? you get loan for a large amount, let's say $100,000, at a specific interest rate, say 3%, for a long term, usually 30 or 20 years, let's say 20 years. And you plan to pay it back with monthly payments. Let's look at your first payment. It will be the interest 3% of 100,000 divided by 12. That computes to 3% x 100,000 / 12 = 3 / 100 x 1/12 x 100,000 which simplifies to 3/12 x 100.000/100 which is 1/4 x 1000 = $250. In addition to that, there will be a part of the principle to pay down. Your monthly payment calculates to $554.60, so the principle part is $304.60. Every month that you pay the mortgage, the interest part goes down and the principle part goes up until at the end you are paying mostly principle and just a little interest. Say you lost your job and the bank lets you pay just the interest. You pay exactly $250, the principle stays at $100,000, but if you can't scrape up the $250 and pay less, say $150, the deficit of $100 gets added to the $100,000, and the principle is now $100,100. So the deficit makes the debt get bigger.

-

Reverse Mortage. Now-a-days you can arrange what is called a reverse mortgage. For example, you arrange with the bank to pay you a fixed amount, say 500 per month at an interest rate, for example 3%, starting with a $100,000 house you have no mortgage on. The first month they pay you $500, and create a principle amount of $500. The next month they pay you $500, but first they add a month's worth of interest on the previous month's payment, = 1/12 x 3% x $500 = 1/12 x 3/100 x 500 = $1.25 so the principle is $501.25 before they pay the second payment. Then the principle becomes $1001.25. Next month the interest is growing. In about 16 years and 7 months the debt (principle) will have reached the $100,000 level. If your house was $100,000, there is no equity left, but in a FHA insured reverse mortgage, the limit is 95% of the value of the house and is the maximum payback requirements. The insurance pays for any amount over that 95% of the value at the house when you sell the house, move out, or leave it to your heirs. There will be a minimum of 5% of the value of the house available for the owner or hiser heirs. In principle, you are using the equity in the house as a fund to draw from and live with, but it's not like a bank account. You own the house, but you get a loan, and you pay interest on the loan up to that 95%. Reverse mortgages are lucrative for the lender. They end up with the house for 95% of it's fixed value at the time of the reverse mortgage. Now let's apply the above to the Country.

-

What is the deficit? It is the difference between what the

Federal government receives and what it pays - the revenue minus the

expenditures. If the expenditures are more than the revenue,

it a deficit; if the expenditures are less than the revenue, it is a

surplus. In the budget, a significant part of the expenses is

the interest on the national debt. The deficit for 2017 was

$666 Billion. The interest on the debt for 2017 was $266 Billion.

For reference, the 2017 Federal expenditures were $4,147 Billion

What is the deficit? It is the difference between what the

Federal government receives and what it pays - the revenue minus the

expenditures. If the expenditures are more than the revenue,

it a deficit; if the expenditures are less than the revenue, it is a

surplus. In the budget, a significant part of the expenses is

the interest on the national debt. The deficit for 2017 was

$666 Billion. The interest on the debt for 2017 was $266 Billion.

For reference, the 2017 Federal expenditures were $4,147 Billion -

What is the National Debt? There are two parts to this. One part is public, how much is owed to people, corporations, and other countries who bought treasury bonds. The other part is intra government, the majority of which is the social security trust funds. If the government were liquidated, those debts would have to be paid as well as the bond holders. The deficit for 2017 was $666 Billion. The National Debt at the end of 2017 was $20.5 Trillion, $14.6 Trillion of which is public. The national debt is a little like a mortgage - borrowing money so we can have more stuff and a higher standard of living, except most of the time we don't make the mortgage payment. We are not paying down the debt like in a home mortgage.

-

The national debt with a deficit is like a reverse mortgage. As long as we run a budget deficit ("getting a payment of money we don't have"), our debt will be a reverse mortgage with the debt and the interest on the debt getting bigger. notice that In 1980 the national debt was $908 billion. It is now more than twenty times that. How did that happen? It was the Reagan Tax cuts and subsequent cuts. The top tax rate was 70% before that. In a short 37 years, the debt has grown to more than twenty-two times. In the same time wages have been stagnant. All that money went to those whose taxes were cut, all the upper income bracket people. Lowering taxes did not pay for itself. That money was not spent on infrastructure, education, or healthcare. It was spent on wars, but mostly given to the wealthiest. Cutting the top rate helps the wealthiest get richer.

| 1932-1981 was 50 years with an average top tax rate of 83.5%.Then Ronald Reagan and the Republicans came to power. | 1932 63%×4 = 252 1936 79%×4 = 316 1940 81%×2 = 162 1942 88%×2 = 176 1944 94%×4 = 376 1946 86%×2 = 172 1948 82%×2 = 164 1950 91%×2 = 182 1952 92%×2 = 184 1954 91%×10= 910 1964 77%×1 = 77 1965 70%×3 = 210 1968 76%×1 = 76 1969 77%×1 = 77 1970 72%×1 = 72 1971 70%×10= 700 1981 69%×1 = 69 1982 sum =4175 50 years average 83.5% | 1982-2008 was 27 years with an average top tax rate of 37%. That amounts to 27 years (plus another 7 since) of embezzling 45.4% of infrastructure and services from the total US commonwealth by the ultra rich people and corporations. | 1982 50%×5= 250 1987 38%×1= 38 1986 28%×3= 84 1989 31%×2= 62 1991 40%×8= 320 2001 39%×1= 39 2002 38%×1= 38 2003 33%×6= 198 2009 sum =1029 27 years average 38.1% |

-

Cutting Taxes is not the fix, cutting taxes caused the problem! As you can see by the chart, the debt started really going "off the chart" when the top tax level was reduced way below the 70% level. The nature of a debt on which interest is not paid is a system with positive (increasing) feedback. Each month the interest is added to the amount owed and the debt grows. This is like a reverse mortage. The amount owed "principle", how much paid to the owner, plus compounding interest, grows faster and faster as the interest builds upon itself. However, the National Debt has no 95% of the value of America limit and no insurance company to "eat" the overage. Like a mortgage, the debt allows us to live in a better standard of living, but continued failure to pay the debt increases the interest cost. The interest on the debt for 2017, was $266 Billion, and it is growing at its most rapid rate. A quarter Trillion dollars can buy a lot of infrastructure and domestic services. It will take more than forty years of huge surpluses to reduce the national debt even close to what it was when the top taxes were 70% or above. The interest on the debt is not optional. It is either paid or it is added to the debt.

- How can we stop the growth of the debt? To halt the growth

of the debt we must eliminate the deficit, $666 Billion Dollars is the

number of that beast last year. No amount of cutting discretionary spending

can do it. Any cutting of those will be self defeating, because that

will be reducing the demand in the economy, and is likely to push us into

another recession, further reducing government revenues, pushing the

deficit up. The only effective solution is increasing the upper rates of

the taxes.

Ralph E Kenyon Jr.

191 White Oaks Road

Williamstown, MA

01267